The Power of Refinancing

84% of recent homebuyers plan to refinance their homes, according to U.S. News & World Report.1

With the conversation around interest rates today, it’s easy to see why. Though some homebuyers are holding out hope for a lower rate before they buy, many are opting to buy now and refinance when the time is right.

There are many benefits that come with owning a home – the ability to build equity, certainty in your mortgage payment and locking in the right home before competition increases. With a little background on how refinancing works, you can decide whether buying now and refinancing later is right for you.

A Brief History of Interest Rates

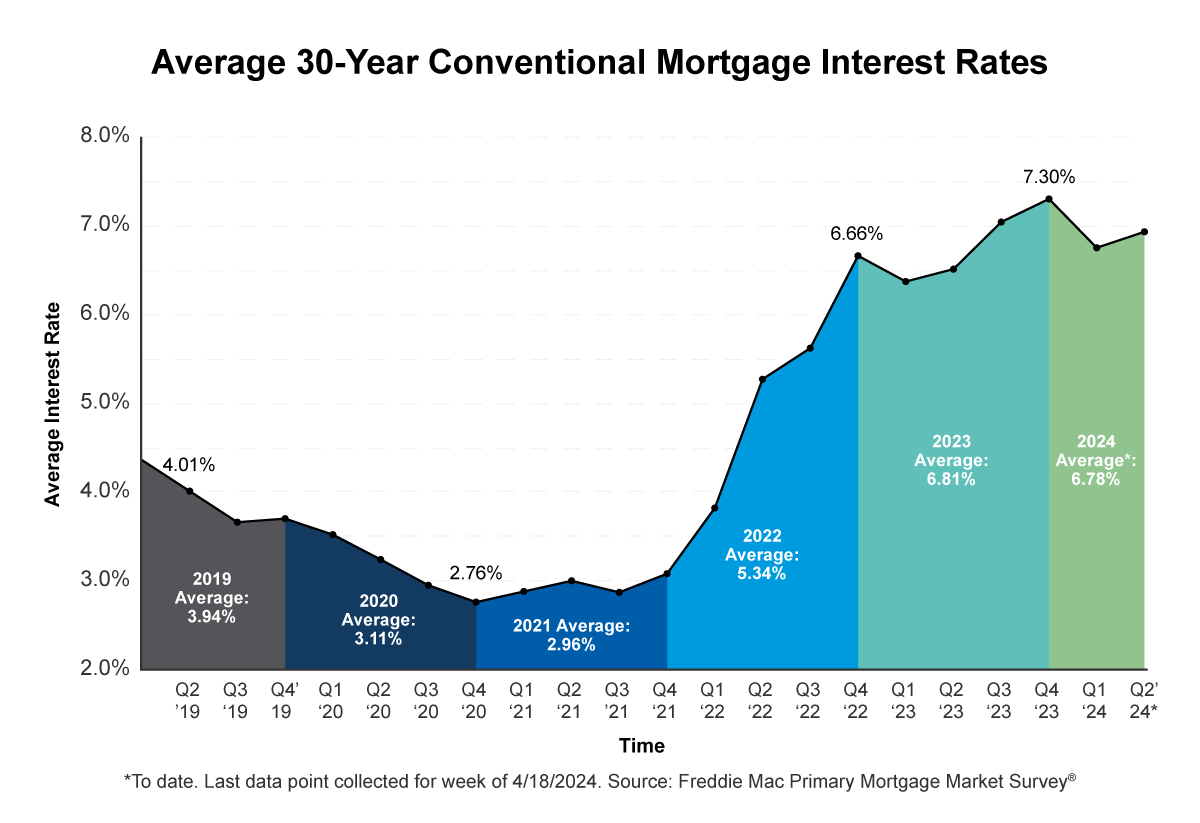

To understand the rate you’re being offered, it’s important to have context on how rates have changed over the last few years. Here are a few points to know:

- The average interest rate over the past 5 years was 4.58%.2

- There was a notable dip in late 2020/early 2021 to as low as 2.65%.3

- Last year, we saw an average interest rate of 6.81%, generally increasing as the year progressed.3

- So far in 2024, the average interest rate is 6.78%.3

- The latest available data point from Freddie Mac was 7.10% for the week of April 18, 2024.3

- So far in 2024, rates have increased month over month.3

So when will rates fall? It’s impossible to say with certainty. Not knowing if or when they could get a better rate, some homebuyers are locking in today’s rate with a plan to refinance if rates decrease.

Why People are Buying Now with Plans to Refinance

There are two strategies for achieving a low interest rate that homebuyers must choose from. First, you can wait for a lower interest rate before beginning your home search. Second, you could buy a home now with plans to refinance when rates improve.

Many homebuyers are opting for that second strategy. Here’s why doing so might make sense for you too:

- It’s a win-win no matter how rates change. Homebuyers are hoping that interest rates will drop, but there’s no guarantee that they will. When you lock in your interest rate, you protect yourself from any further rate increases. And if rates do drop, you can refinance and take advantage of that.

- With a mortgage, your payments may increase your equity each month. Every month that you pay towards your principal mortgage balance, you’re increasing your equity in your home. You can take advantage of this equity if you sell the home later or take out a Home Equity Line of Credit.

- If you wait, you may be facing more competition in the future. Better interest rates often translate to more homebuyers and a more competitive market. It may be harder for you to find the right home and get an offer accepted if you put it off until rates improve.

- There’s no end date on waiting for a better rate. No one can predict how or when rates will change – which means you could be waiting for the “right time” for years. Each passing month could mean a missed opportunity to build equity and enjoy living in your own home.

Not every benefit of buying now can be put into numbers.

Seeing your kids start at a new school, removing the hassle of dealing with landlords or showing off your new home to family aren’t things we can quantify. The memories you’ll make in your new home are forever, but your interest rate doesn’t have to be.

Questions to Ask Before Buying a Home

There are still a lot of factors to consider before deciding whether buying a home now is right for you. Here are a few questions to answer as you consider buying a home.

-

What monthly payment can you afford? Even if you’re planning to refinance, it’s important to make sure your payments are manageable. Use our mortgage calculator to explore what your monthly payments might look like, how much home you can afford and more.

-

What will your interest rate actually be? It’s important to know that the market rate is not necessarily your interest rate. Rates may depend on your credit profile, your lender and other factors. Getting pre-qualified is the first step to really understanding what rate you qualify for.

-

What assistance programs are available to you? Down payment assistance and other programs may help you purchase a home – especially if you are a first-time homebuyer. Options vary based on many factors, but your Loan Officer will help you decide which programs you may benefit from.

We’re Here to Help You Make an Informed Decision

At Lennar Mortgage, we’re dedicated to helping our Customers understand their options and make the right decision for their situation. After pre-qualification, you’ll be paired with a local Loan Officer who will help you compare your options and take advantage of any assistance programs you may qualify for.

Get pre-qualified today to get started!