2026 Increases to Loan Limits

Every year, loan limits for Conventional and FHA loans are evaluated and adjusted to reflect changes to housing prices. These new, higher loan limits will take effect January 1, 2026, increasing your buying potential in the new year. Here’s what is changing in 2026.

What is Changing?

The Federal Housing Finance Administration (FHFA) sets Conventional conforming loan limits yearly to reflect the average home price in the U.S. Changes to the conforming loan limits for Conventional and FHA loans go into effect on January 1st of each year.

A loan limit is the maximum amount an applicant may borrow. They vary based on the type of property that is being bought (such as single-family vs. multiple-unit) and the county it’s located in.

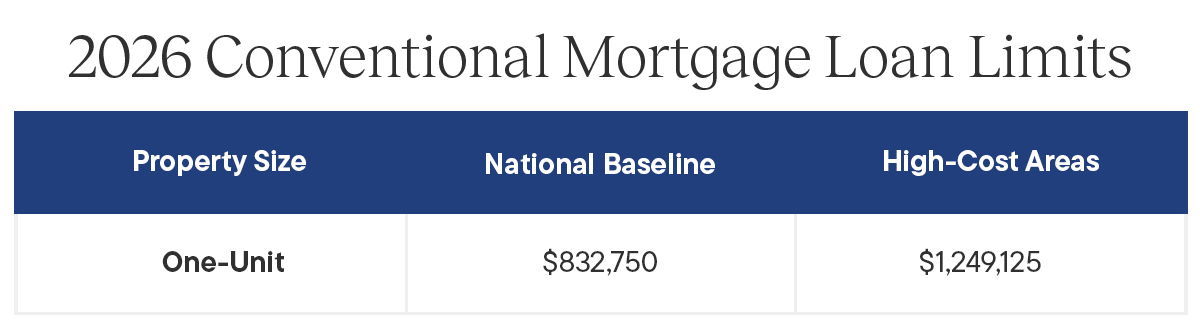

What is the 2026 Conventional Loan Limit?

A Conventional Loan is often referred to as a Conforming Loan because it conforms to requirements set by Fannie Mae and Freddie Mac, two agencies that standardize mortgages. There are many benefits to using a Conventional Loan, including flexible qualifying guidelines for your down payment, loan term, and rate options.

The 2026 national baseline Conventional conforming loan limit for one-unit properties is $832,750. In high-cost areas, the limit increases to $1,249,125. The exact limit of what you can borrow will depend on your county, as shown in FHFA’s Loan Limit Map.

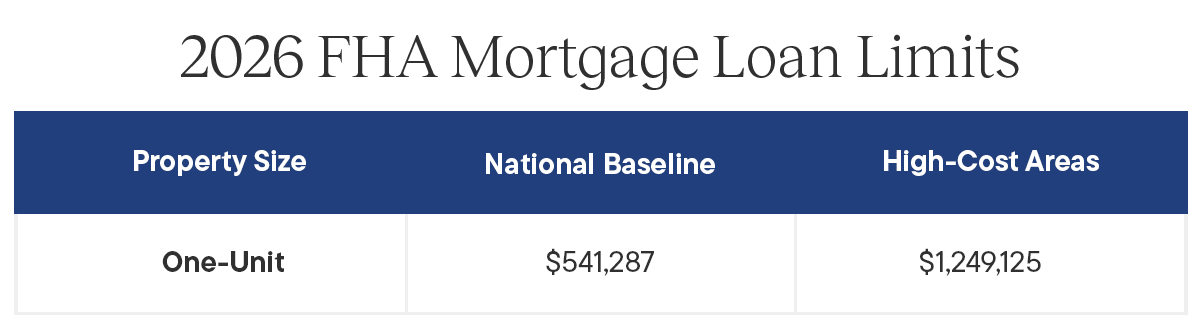

What is the 2026 FHA Loan Limit?

FHA loans, administered by the Federal Housing Administration (FHA), are a popular option for first-time homebuyers. With a low-down payment minimum and flexible qualifying criteria, there are many benefits that appeal to all kinds of homebuyers.

Loan limits for FHA mortgages are set at 65% of the Conventional conforming loan limits for the year. Similar to Conventional Loans, limits vary based on property size and county.

The 2026 national baseline FHA loan limit for one-unit properties is $541,288. In high-cost areas, the limit may increase up to $1,249,125. Ask your Loan Officer to learn the FHA loan limit in your area.

How Will These Changes Affect Me?

Loan limits increase each year to reflect changes in median house prices, helping homebuyers keep up with prices in their area. With higher limits for Conventional and FHA Loans in 2026, you have more opportunities to find a mortgage that works for your dream home!

Want to see how these changes affect your ability to buy your dream home? We’re here to help! With a dedicated Loan Officer by your side, you can make sense of these new numbers, compare loan options, and find the perfect financing for your new Lennar home. Connect with a Loan Officer to get started!

Sources:

FHFA Announces Conforming Loan Limit Values for 2026, Federal Housing Financing Agency

FHA Loan Limits, Zillow

Model(s)/lifestyle photo does not reflect racial or ethnic preference. The content herein is for informational purposes only. Nothing herein shall constitute legal, tax, investment, or financial advice. No representation is made regarding your ability to qualify for a home loan or the availability of a home or loan product that meets your needs. Lennar Mortgage, LLC – NMLS # 1058. Copyright © 2025 Lennar Corporation and Lennar Mortgage, LLC. All rights reserved. Lennar, the Lennar logo and the Lennar Mortgage logo are U.S. registered service marks or service marks of Lennar Corporation and/or it subsidiaries.