How do Interest Rates Affect Purchasing Power?

Purchasing power refers to the price of the home you can afford based on the budget you have available. Naturally, if interest rates start to increase, you will not be able to afford the same home on the same budget. In a nutshell, you will be paying more for the same home if the interest rates rise.

How do Interest Rates Affect Purchasing Power?

The impact of purchasing power makes it important to jump on your dream home when interest rates are low. The mortgage interest rate determines your monthly payment, as well as the total lifetime cost of your mortgage. Until you lock in your interest rate, the current rates being offered may change due to market fluctuations. Locking in your rate when you deem it appropriate will allow you to properly budget for the future costs of your new home!

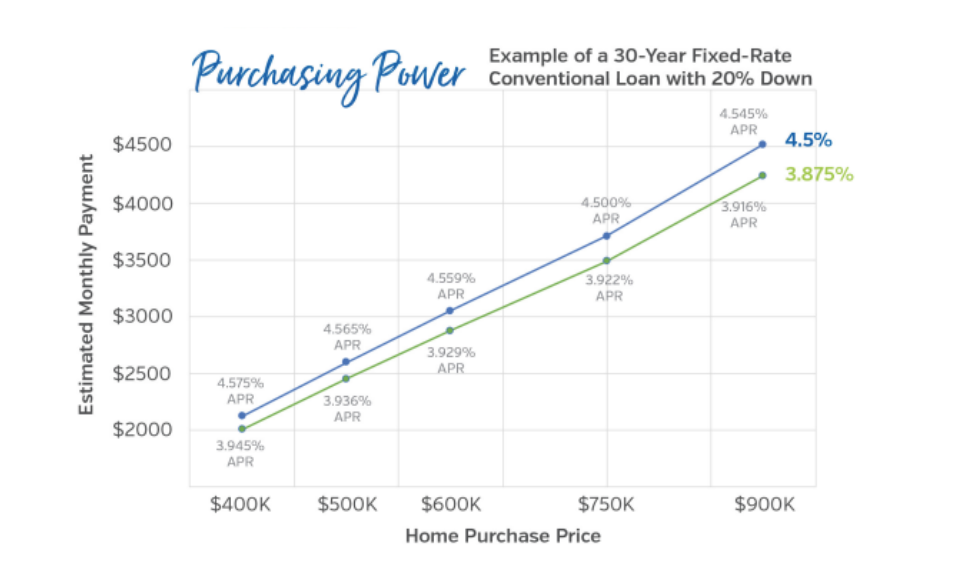

Just how powerful are interest rates when it comes to purchasing power? As you can see in the chart below, the higher the interest rate, the higher the monthly payment. Meaning the less house you can afford. “A 1% point drop in rates — such as from 4.5% to 3.5% — leads to a monthly savings of $167 on a $200,000 mortgage,” says Lawrence Yun, chief economist for the National Association of Realtors.

*This chart is for informational purposes only. Sample rates and APRs are based on interest rates and terms available as of 6/07/2019, factoring in prepaid finance charges (per diem interest and closing fees). Interest rates could vary or change without notice; buyer is subject to qualifications for specific loan terms, occupancy, down payment, credit and underwriting requirements, and/or investor program guidelines. This is not an offer to enter into an interest rate or discount point agreement and any such agreement may only be made in writing, signed by both the borrower and lender.

You can use our mortgage calculator to see the incredible effect of interest rates for yourself. As you slide the interest rate higher, you can see how much your monthly payments would climb to pay off the cost of the same home.

Mortgage rates have been near record lows over the past few months. That means many prospective homebuyers can likely afford a more expensive home than they previously thought. With Lennar Mortgage, get prequalified for your dream home and find out what your purchasing power is!