Spending Smart with Credit Cards

Throughout the year, there are always temptations and reasons to pull out your credit card: kids’ birthday parties, hosting events, holiday shopping and more.

The holiday season is a perfect example. Along with all the joy and family time comes a whole lot of pressure to spend. Whether it’s indulging your children with presents, traveling to visit family or buying new seasonal decor to match the latest trends, many families struggle with sticking to a budget as the year ends.

Overspending or maxing out your credit card can have lasting effects on your finances, including affecting your ability to qualify for a mortgage. Let’s take a look at the state of spending today, how it affects your credit and how to spend with your financial future in mind.

How Spending Adds Up

If you’ve overspent in the past, you’re not alone. The average American household in Q2 2025 held upwards of $10,000 in credit card debt1. Credit card usage has grown steadily, with year-over-year delinquencies rising since 20212.

Spending on credit cards isn’t always a bad thing. However, about 60% of Americans carry over a balance month-to-month3 — and that can add up fast.

When you don’t pay your credit card balance off at the end of the month, that balance will begin to accrue interest. And credit cards carry some hefty interest rates — an average of over 25% at the time of writing3. That means if you carry over a balance for a year and only make minimum payments, you’d end up owing about $250 extra for every $1,000 you spent with your credit card.

The “minimum payment” on a credit card can be a slippery slope. Paying just the minimum barely puts a dent in your principal balance, which continues to accrue interest and increase how much you’ll owe.

How Credit Cards Affect Your Credit Score

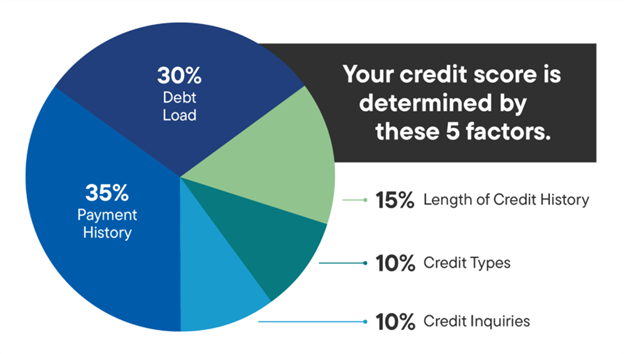

There are several ways that credit card usage will affect your score. First, let’s break down what components contribute to your credit score.

-

30%, Debt Load: Often called credit utilization, this shows what percentage of available credit you use. Getting close to your credit limit or maxing out a credit card will lower this portion of your score.

-

15%, Length of Credit History: The average age of your open accounts shows how long you’ve been managing credit. Keep this in mind when considering closing a credit card account — the longer you’ve had a card, the more closing it may affect this portion of your score.

-

10%, Credit Types: Also called credit mix, this portion of your score looks at what types of accounts you have. Having a mix of revolving credit, like credit cards, and installment credit, like auto loans or mortgages, can improve your score.

-

10%, Credit Inquiries: A hard inquiry, which lenders perform with your consent when you apply for a new line of credit, can temporarily lower your score. It’s a good idea to avoid opening new credit cards or taking out auto loans before applying for a mortgage.

Credit cards can impact every part of your credit score. Managing several credit accounts well over time can increase your score and show future lenders an established history of paying your debts. However, the inverse is also true — holding high balances or missing payments on your credit cards can get in the way of your future financial goals.

Smart Spending Habits

Knowing they can make or break your credit score, you have the power to use credit cards to your advantage! Let’s go over changes to your habits that can slowly build up your credit score and improve your ability to qualify for a mortgage in the future.

Set and stick to a budget.

There's a reason budgeting is mentioned so often. Many people don’t really know how much they’re spending, especially during holidays and celebrations.

Take some time to calculate how much you spend each month in categories such as groceries, utilities, housing and entertainment. Keeping your monthly income in mind, determine where you can make cuts and set a budget for what you should spend in each category going forward.

You can also set budgets for birthdays, holiday spending and more. The important thing is holding yourself accountable to your budget, even when it means changing your habits and skipping certain purchases.

Pay off your credit card, or pay more than the minimum, each month.

The ideal way to use credit cards is to fully pay the balance before the due date each month. With this strategy, you won’t accrue any interest, though you’re still building a solid credit history that lenders will appreciate.

If you have a large balance already, you’ll have to work towards it. The important thing is to pay more than the minimum payment. Figure out how much you can afford to pay each month and slowly pay down your balance. Until your credit utilization is under around 30% of your credit limit, avoid using your credit card.

If you have multiple cards you need to pay off, it may help to focus on the one with the highest interest rate first, while still making at least the minimum payments on all your cards.

Don’t fall for the pressure to spend.

One of the reasons people get into credit card debt is pressure to spend, either from themselves or from people around them.

56% of people reported feeling pressured to spend money during the holidays, with the majority citing family expectations.4 During the holidays and beyond, comparing ourselves to others, keeping up with trends or trying to create memories through purchases can lead to lingering debt.

Alleviating both the mental and financial stress begins with saying no to expectations. Spending time with loved ones, honoring traditions or finding ways to express yourself doesn’t have to mean making purchases. In fact, spending time instead of money on the people, hobbies and traditions you love can be much more gratifying.

Give some thought to which of your spending habits are motivated by pressure. Then, find ways to replace them that align more with what really matters to you.

Bouncing Back from Overspending

If you’ve already got more credit card debt than you’re comfortable with, don’t lose hope. Improving your credit score and decreasing your debt is possible with steady changes over time.

Understanding how credit works is the first step to achieving your financial goals. That’s why we offer a complimentary credit education program, HomeBuyer Solutions Group, to guide you through the basics of credit. With our HBSG program, homebuyers are paired with a knowledgeable Credit Specialist, given a personalized action plan and held accountable for taking steps to improve their own credit.

Our team is here to help you overcome credit challenges and finance your dream home. Many graduates of HomeBuyer Solutions Group have gone on to qualify for a mortgage with us. To see if you’d benefit from this program, get pre-qualified today*!

Sources:

1Credit Card Statistics, WalletHub

2Why Are Credit Card Rates So High?, Federal Reserve Bank of New York

3What Is The Average Credit Card Interest Rate This Week? November 24, 2025, Forbes

461% of shoppers say the holiday season is financially terrifying, StudyFinds

*Requesting a loan pre-qualification and making a loan application does not constitute a loan approval or otherwise indicate that a consumer has or will qualify for a loan from Lennar Mortgage, LLC. Pre-qualifying with Lennar Mortgage, LLC is voluntary and is not required in order to obtain a loan from Lennar Mortgage, LLC and/or purchase a home from Lennar Corporation or any of its affiliated homebuilders. Pre-qualification does not (a) constitute a loan approval or indicate that you have or will qualify for a loan from Lennar Mortgage, LLC [or any other lender], or (b) guarantee you will qualify to purchase a Lennar home.

Lennar Mortgage, LLC’s Home Buyer Solutions Group (HBSG) is a voluntary program and participation is not required in order to obtain a loan from Lennar Mortgage, LLC and/or purchase a home from Lennar Corporation or any of its affiliated homebuilders. Participants enrolling in HBSG are under no obligation to purchase a Lennar home or obtain a mortgage loan from Lennar Mortgage, LLC. Completion of the HBSG program does not (a) constitute a loan approval or indicate that the participant has or will qualify for a loan from Lennar Mortgage, LLC or any other lender; (b) guarantee the participant will qualify to purchase a Lennar home; or (c) guarantee any improvement of the participant’s credit rating or history. Upon enrollment, the participant must provide pertinent financial information and must authorize HBSG authority to obtain and analyze the participant’s credit report. The content provided herein is for informational purposes only. Nothing herein shall constitute legal, tax, investment or financial advice. No representation is made regarding your ability to qualify for a home loan, your ability to improve your credit score or the availability of a home or loan product that meets your needs. Model(s)/lifestyle photo does not reflect racial or ethnic preference. Lennar Mortgage, LLC-NMLS # 1058. © 2025 Lennar Corporation and Lennar Mortgage, LLC. All rights reserved. Lennar, the Lennar logo, Lennar Mortgage and the Lennar Mortgage logo are U.S. registered service marks or service marks of Lennar Corporation and/or its subsidiaries.